VMPL

New Delhi [India], April 11: In today’s digital-first world, managing your investments has become easier and more efficient, thanks to the availability of online platforms. One of the most essential tools for modern investing is the demat account, which is used to hold your financial securities in electronic format. Whether you invest in shares, bonds, mutual funds, or ETFs, a demat account plays a critical role in safekeeping and managing your investments.

This article explains the main benefits of using a demat account today, particularly for those who are new to online investing or want to understand how to handle multiple investment instruments like ETF units and equities under a single platform.

What is a demat account?

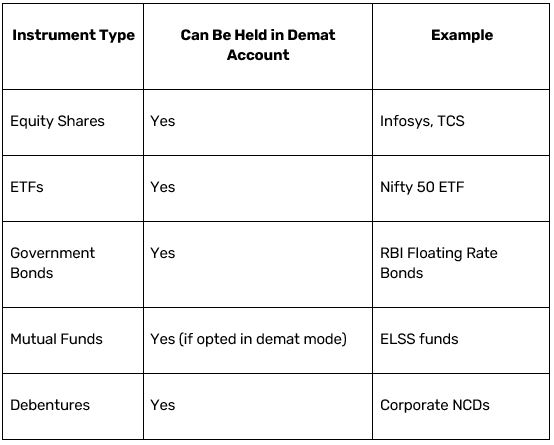

A demat (dematerialised) account is an account that allows you to hold securities such as shares, ETFs (exchange traded funds), government bonds, and mutual fund units in electronic format. It eliminates the need for physical certificates and enables quicker, safer, and more convenient transactions.

The account functions similarly to a bank account, but instead of holding money, it holds investment securities. It is regulated by SEBI and can be opened through a registered depository participant (DP).

Why demat accounts are important in today’s investment landscape

The financial ecosystem has become increasingly digital and investor-friendly. Stock exchanges like NSE and BSE now operate completely electronically. As a result, having a demat account is a basic requirement to buy or sell shares and other listed instruments on Indian exchanges. Moreover, the popularity of digital investment products such as ETFs has further increased the demand for efficient and secure account management.

Key benefits of using a demat account

1. Safe and secure storage of investments

One of the most significant advantages of using a demat account is the elimination of risks associated with physical certificates such as theft, forgery, loss, or damage. Your holdings are maintained in a centralised, secure electronic system, reducing administrative burden and ensuring safety.

2. Easy access to ETFs and other instruments

A demat account allows you to hold a wide range of financial instruments, including ETFs, stocks, bonds, and mutual funds, all in one place. With ETFs gaining popularity among investors for their low-cost and diversified structure, the ability to buy and sell them seamlessly through your demat account adds great convenience.

3. Faster and seamless transactions

All transactions in a demat account are executed electronically. This ensures that buying and selling of securities happen quickly, usually within T+1 or T+2 days depending on the instrument. It removes the delays that were earlier associated with paperwork and manual processes.

4. Easy tracking and portfolio management

By consolidating all your investments in a single demat account, you can easily monitor the performance of your entire portfolio. This helps in making informed decisions and maintaining better financial discipline. Most depository participants also provide access to portfolio reports and real-time data through mobile apps and dashboards.

5. Reduced paperwork

Gone are the days of filling out multiple physical forms for every investment. With a demat account, processes like applying for IPOs, transferring shares, and updating personal information have become simpler and digital. This reduces time and enhances efficiency.

6. Corporate benefits made easier

When you hold shares in a demat account, corporate actions such as dividend payouts, bonus issues, stock splits, and rights offerings are automatically updated. There is no need to track each benefit manually, as the credit reflects directly in your account once processed.

7. Easy nomination and transmission

A demat account allows you to appoint a nominee, making the process of asset transmission smoother in case of unforeseen events. This ensures that your financial assets are easily passed on to your chosen family member or beneficiary.

8. Helpful in IPO applications

Applying for IPOs (Initial Public Offerings) requires a valid demat account. When you apply for an IPO using ASBA (Applications Supported by Blocked Amount), the allotted shares are credited directly into your demat account. Without one, you will not be able to participate in primary markets.

9. Reduced cost of transactions

Although charges vary by depository participant, electronic transactions via demat accounts are generally cost-effective compared to physical modes. There are no stamp duties on electronic transfer of shares, and brokerage costs are also streamlined.

10. Real-time alerts and updates

With real-time SMS and email alerts, you stay informed about every activity happening in your account–whether it is buying, selling, credit of dividends, or any account update. This adds a layer of transparency and control to your investment journey.

How demat accounts support ETF investments

Exchange traded funds (ETFs) are listed on stock exchanges and traded like regular shares. Each ETF unit represents a basket of securities, such as Nifty 50 stocks or gold. Since ETFs are traded just like stocks, they need to be held in a demat account.

If you are investing in ETFs, here is how a demat account supports your journey:

* Provides storage for ETF units in electronic form

* Enables seamless buying and selling during market hours

* Makes redemption and dividend payments simple and transparent

* Allows tracking ETF performance through your consolidated holdings

Opening your demat account – basic process

To start using a demat account, you can follow these steps:

1. Choose a SEBI-registered depository participant (DP).

2. Fill the account opening form and complete KYC.

3. Submit required documents such as PAN card, Aadhaar, and bank details.

4. Sign an agreement with your DP.

5. Upon verification, your account will be activated and your login details shared.

Once the demat account is ready, you can link it to your trading account and start transacting in ETFs, equities, and other instruments.

Conclusion

A demat account is essential for today’s investors who want a secure, convenient, and efficient way to handle their investments. Whether you are trading in equity shares or investing in diversified instruments like ETFs, a demat account allows you to do so seamlessly. It also enhances your control over the investment process, enables faster transactions, and supports better record keeping. As financial products continue to digitise, having a demat account is no longer optional–it is a necessity for efficient investment management.

While the stock market presents potential opportunities, you must always conduct thorough research, assess your financial goals, and understand your risk tolerance before making any investment decisions.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages